How To Buy A House In Japan As A Foreigner

Many foreigners, both in and outside Japan, are interested in buying a house in Japan. If that sounds like you, you've come to the right place!

This article discusses how to buy a house in Japan as a foreigner and what documents you need to make the process smooth.

Residency, visas, and property ownership in Japan

Quick summary:

✅Owning a house in Japan does not give you permanent residence or visa rights.

✅Non-residents can buy property freely, with very few restrictions.

✅Your ability to stay in Japan depends on your visa, not your property.

Can a foreigner purchase property in Japan?

Yes, foreigners can buy property in Japanese real estate. They have the same property rights as Japanese citizens. You do not need to hold permanent residency status or hold any visa type when buying into the Japanese property market.

One regulation that affects foreign buyers would be the Foreign Trade Control Act, which bans foreigners from buying property that is close to Japan's Self-Defense bases and property that is designated as "agricultural" or "forest."

The Foreign Exchange and Foreign Trade Control Act (FEFTA) restricts:

Agricultural land (requires government permission)

Forestry land (requires government permission)

Properties within 1km of Self-Defense Force bases

Some condominium buildings may have internal rules restricting foreign ownership

Aside from those legal restrictions, the only other barriers foreign buyers may face are the language barrier and lots of paperwork, which we'll get into later.

Does buying property in Japan give you permanent residency status?

No.

Japan does not offer permanent residency, long-term visas, or citizenship in exchange for purchasing real estate.

Even if you buy a vacation home or multiple properties, your immigration status does not change.

To live in Japan long-term, you must hold a visa under one of Japan’s official residence categories, such as:

Work visas (Engineer/Specialist in Humanities/International Services, Instructor, Skilled Labor, etc.)

Spouse of a Japanese national or permanent resident

Permanent Residency (separate application process)

Student visa

Business Manager visa

Highly Skilled Professional visa

Buying property can support your lifestyle in Japan, but it does not automatically grant you any visa type on its own.

Does owning property help future visa applications?

Property ownership does not grant visa eligibility, but in some cases it can strengthen your supporting documents:

For Business Manager visas, a real estate purchase may help if the location is used as an office.

For Highly Skilled professional visas, it can demonstrate stable income (but it is not a scoring item).

For Spouse or Long-Term Resident visas, property ownership may support your overall financial profile.

Still, immigration authorities do not treat property as a pathway to residency.

Taxes and ownership implications for foreigners

Foreigners can freely purchase real estate in Japan, but ownership comes with specific tax obligations.

Equal ownership rights

Freehold ownership of land and buildings

No restrictions on resale

No limits on holding periods

No currency control on sending funds abroad (with FEFTA reporting rules)

Obligations

Foreign owners must:

Pay local taxes annually

Maintain the property to municipal standards

Appoint a tax agent if living abroad

Comply with rental regulations (e.g., Minpaku/STR rules)

Below is a clear breakdown of the taxes you will encounter when purchasing, while owning, and when selling or renting out property in Japan.

Phase |

Tax / Cost |

Typical Rate |

Buying |

Stamp Duty |

¥10,000–100,000 |

Registration Tax |

0.4%–2% |

|

Acquisition Tax |

3%–4% |

|

Owning |

Fixed Asset Tax |

1.4% |

City Planning Tax |

0.3% |

|

Rental Income Tax |

5%–45% |

|

Selling |

Capital Gains (<5 yrs) |

39% |

Capital Gains (>5 yrs) |

20% |

1. Acquisition taxes (when you buy)

Tax |

When It Applies |

Rate / Amount |

Notes |

Acquisition tax |

4–6 months after purchase |

4% of assessed value (usually discounted to 3%) |

Assessed value is typically lower than market price. |

Registration & license tax |

At legal registration |

0.4%–2% depending on asset type |

Required to register ownership and mortgage. |

Stamp duty |

At signing of contract |

JPY 10,000–100,000 |

Based on contract value. |

Judicial scrivener fee |

During registration |

JPY 50,000–150,000 |

Administration/legal fee. |

Real Estate Acquisition Tax (不動産取得税, fudousan shutoku zei)

A one-time prefectural tax charged a few months after purchase.

-

Rates:

Land & Residential Buildings: 3% (temporarily reduced; standard is 4%)

Non-residential buildings: 4%

The assessed value is usually lower than the property price, sometimes significantly.

Registration & license tax (登録免許税, touroku menkyo zei)

Paid at the time of registration and handled via the judicial scrivener.

Typical rates:

Ownership transfer: 0.4% of assessed value

Mortgage registration: 0.1% (often reduced)

Newly built homes: May qualify for reduced rates

Stamp Duty (印紙税, inshi zei)

Required on the sales contract:

Ranges from ¥10,000 to ¥60,000, depending on purchase price.

2. Annual taxes (while you own the property)

Tax |

What It Is |

Rate |

Frequency |

Fixed Asset Tax |

Annual property tax |

1.4% of assessed value |

Annually |

City Planning Tax |

Infrastructure tax in urban areas |

0.3% |

Annually |

Income tax (if renting out) |

Tax on income from renting out your property |

5%–45% (progressive) |

Annually |

Depreciation Benefits |

Reduces taxable rental income |

Depends on building type & age |

Annually |

Fixed asset tax (固定資産税, kotei shisan zei)

Standard rate: 1.4% of assessed value.

Collected by the city/ward annually.

Newly built homes may qualify for 50% reductions for the first 3–5 years.

City planning tax (都市計画税, toshi keikaku zei)

Additional annual tax of 0.3% (if applicable in that municipality).

Applied to areas with approved city development plans.

Special notes for foreign owners

-

Tax bills are mailed only within Japan, so nonresident owners typically:

Use a property manager

Appoint a tax agent

Failure to name a tax agent can lead to missed bills and penalties.

3. Income Taxes (if you rent out your vacation home or property)

Rental income tax

Foreigners renting out property must pay Japanese income tax on rental earnings.

Tax rate depends on residency status:

If you are a tax resident (living in Japan):

Progressive rates from 5% to 45%, plus 10% local inhabitant tax.

If you are a non-resident:

20.42% flat withholding tax applied to gross rent.

Property managers withhold monthly and remit to tax authorities.

Deductions allowed

You can deduct:

Maintenance & repairs

Management fees

Building depreciation

Mortgage interest

Fire/earthquake insurance

Property taxes

Non-residents must file a Non-Resident Income Tax Return if deductions apply.

4. Capital gains tax (if you sell the property)

Ownership Period |

Capital Gains Tax (National + Local) |

Total Effective Rate |

Less than 5 years |

30% + 9% |

39% |

More than 5 years |

15% + 5% |

20% |

Japan taxes capital gains differently depending on how long you’ve owned the property.

Short-term (Owned 5 years or less)

39.63% (30% national + 9% local taxes)

Long-term (Owned more than 5 years)

20.315% (15% national + 5% local taxes)

The “five-year rule” is based on January 1st, not the purchase date.

Special notes for foreign sellers

If the seller is a non-resident, the buyer must withhold 10.21% of the purchase price and remit it to tax authorities.

The seller then files a tax return to claim any refund due.

5. Inheritance & gift tax implications

Japan has strict rules for inheritance and gifting property, and they apply differently to foreigners depending on residency and timing.

Inheritance tax (相続税, souzoku zei)

If you pass away while owning Japanese property:

Your heirs may owe inheritance tax in Japan, regardless of their nationality.

Tax rates range from 10% to 55%, depending on value.

Gift tax (贈与税, zouyo zei)

If you gift the property (e.g., to a spouse or child):

Japan’s gift tax rules may apply if either the giver or receiver has certain residency connections to Japan in the past 10 years.

Important: These rules are complex for foreigners. Professional tax advice is recommended for estate planning.

6. Consumption Tax (On New Properties or Certain Transactions)

Consumption tax (VAT) in Japan is 10% but applies only in specific situations:

Applies to buildings sold by a business entity (e.g., developer)

Does not apply to land

Does not apply to resale properties sold by individuals

If you buy a new condo from a developer:

Portion of the price attributed to the building includes a 10% consumption tax.

How to buy a house in Japan as a foreigner living abroad

Here's the general purchase process for buying a house in Japan.

Step-by-step guide for buying a house as a foreigner

Buying a house in Japan: a step-by-step guide

1. Use akiya banks and real estate websites to view properties online

There are many akiya banks and real estate market websites for foreign buyers with property listings.

These sites will show you the available residential properties in and around Japan, including akiya houses for sale and newly built houses.

If you're currently living overseas, depending on the real estate agency, real estate staff can arrange an online viewing of the property.

Note: Interested in learning how to evaluate an akiya purchase? Check out this interview with Akiyaz founder, Matt Ketchum.

2. Submit your purchase application

Submit a purchase application once you decide on your property purchase.

The real estate agency you work with will help you with the application process, from filling out necessary forms to submitting required documents and ensuring all legal requirements are met.

Once the application is approved, the purchase agreement and formal contract outlining the terms and conditions of the sale will be drafted.

3. Payment and transfer of ownership

For this final step, it's best to be in Japan so that you can attend the signing of the sales agreement.

Additionally, for the property to legally be in your name, you and a judicial scrivener must submit a property register certificate (登記簿謄本, tokibotohon) to the Legal Affairs Bureau.

👉 Looking for an English speaking realtor? Check out this article!

Important documents when buying a house in Japan as a foreigner living abroad

Foreigners who are not residents of Japan and have no visa status will need to prepare several key documents when buying property in Japan.

a) Affidavit of residency or citizenship status

A legal document proving your residency or citizenship status outside Japan is usually prepared by a lawyer.

b) Power of attorney

This is a document granting the local real estate agent in Japan the authority to complete real estate transactions on your behalf.

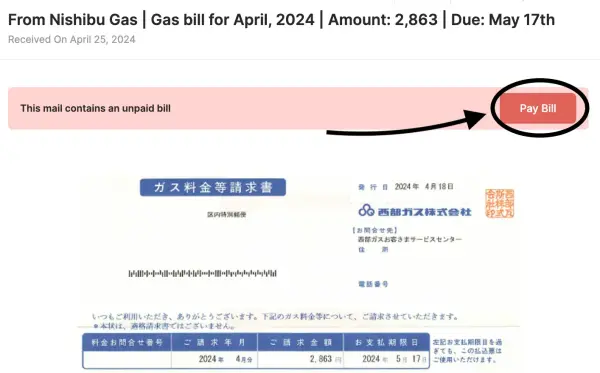

c) Utility bill management

How to pay bills through MailMate’s online dashboard

While you may not always plan to stay in your Japanese property, you'll still need a plan in place to pay for your utilities—such as your gas, electricity, water, and internet bills—while you are away.

Using a virtual mailbox service like MailMate allows you to receive your mails and bills online and MailMate will help pay your bills on your behalf.

d) Translation service

If you are in contact with a Japanese akiya and real estate company that does not provide bilingual services, using a translation service is extremely helpful for better communication. About 2-3 days of their service is needed.

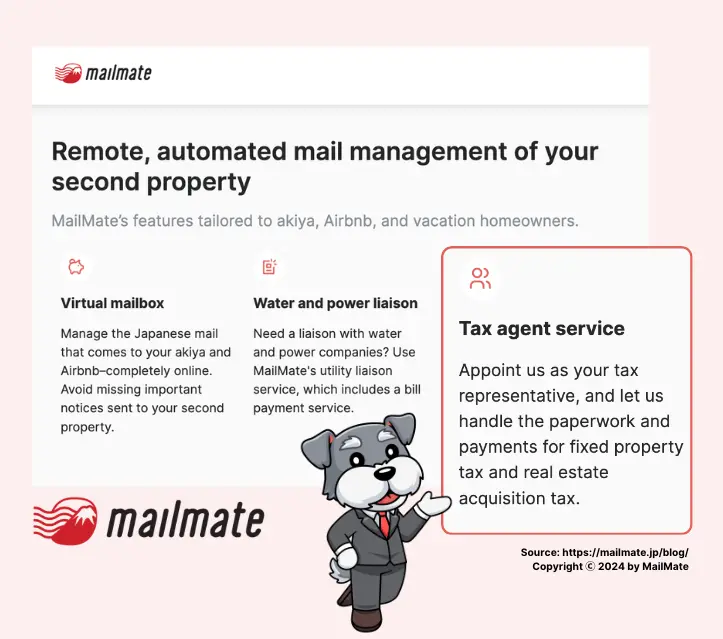

e) Tax agent / tax representative

After you've purchased your house, if you don't plan on living there full time, you'll want to appoint someone in Japan to handle your property tax, real estate acquisition tax, fixed asset tax, and city planning tax payments on your behalf when you are away from the country.

Designate MailMate as your tax agent to help you handle all property-related taxes!

Purchase costs (in addition to property price)

Here's a breakdown of what your real estate purchase will cost, including registration fees, associated costs, and taxes.

Cost Category |

Percentage |

Typical Amount (¥5M property) |

Notes |

Real Estate Agent Fee |

3% + ¥60,000 + tax |

¥226,800 |

Standard rate, non-negotiable |

Registration and License Tax |

2% (land) + 0.4% (building) |

¥120,000 |

Reduced rates for new buildings |

Stamp Duty |

¥10,000-¥200,000 |

¥20,000 |

Based on contract value |

Judicial Scrivener Fee |

¥50,000-¥150,000 |

¥80,000 |

Property registration |

Property Inspection |

¥50,000-¥100,000 |

¥70,000 |

Highly recommended |

Translation Services |

¥30,000-¥80,000 |

¥50,000 |

For contracts and documents |

Fire Insurance |

¥20,000-¥50,000/year |

¥35,000 |

Mandatory for financed properties |

Bank Loan Fees |

1-3% of loan |

¥150,000 |

If financing |

Total Additional Costs: 8-12% of property price

Annual ongoing costs for a house in Japan

Your investment property in Japan will have ongoing annual costs. Here's an overview of what to expect.

Cost |

Annual Amount |

Notes |

Property Tax |

1.4% of assessed value |

Paid in 4 installments |

City Planning Tax |

0.3% of assessed value |

Urban areas only |

Building Management |

¥20,000-¥50,000/month |

Condominiums only |

Fire Insurance |

¥20,000-¥50,000 |

Required renewal |

Utilities |

¥15,000-¥30,000/month |

If occupied |

How to buy a house in Japan as a foreigner

Now, it's time to tackle how to buy a house in Japan as a foreigner who is a resident of Japan (i.e., with a Japanese visa).

Buying a house in Japan is similar to renting a place here—give or take a few more documents.

Here's what to expect as a resident foreigner looking to purchase real estate:

Requirements for foreigners buying a house in Japan

As a foreigner living in Japan, you will need to prepare these items when buying a house in Japan.

1. Valid residence card

Example of residence card from ISA Japan

All foreigners living in Japan are required to have a residence card (在留カード, zairyu card).

2. Registered seal

Example of registered seals

For formal documents in Japan, instead of signing with a signature, you will need a jitsuin (実印), a registered hanko with the municipal office of a city, ward, town, or village.

Depending on the real estate company and agent, you may be able to get by without one. However, the paperwork process will go a little more smoothly if you have at least a hanko.

Obtaining a hanko is inexpensive. I got mine for about 600 yen (less than $5). I used my hanko for my rental apartment agreement, and I also needed one when getting a Japanese bank account.

After registering your seal, you will receive the registration certificate (印鑑証明書, inkan shomeisho), which is equivalent to a notarized signature.

If you don't have a hanko, you may be able to use a notarized signature instead.

3. Bank account in Japan

Opening a bank account in Japan can be difficult for foreigners, but once you have one, you're all set. A few English-friendly financial institutions for foreigners include:

Shinsei Bank

SMBC Trust Bank

Sony Bank

Japan Post Bank (Yucho)

Having a bank account in Japan when buying a property in Japan demonstrates financial stability and credibility.

4. A loan from a Japanese bank

Loans are not always required, such as when paying in full or making the payment in cash.

However, some Japanese banks and Japanese financial institutions offer special financing options or incentives for those who are interested in buying property in Japan.

So contact your Japanese bank to see their options.

5. Guarantor from a guarantor company

Sometimes, a guarantor from a guarantor company is needed when buying property in Japan for additional financial security for lenders or sellers.

The guarantor company assures the lender or seller that payments will be made, even if the buyer cannot.

In some cases, Japanese banks and real estate firms will require a guarantor for real estate transactions. However, not all banks and real estate agreements will require you to have one, so you'll want to ask your bank for details.

Timeline expectations

Understanding the typical timeline for a property purchase can help set realistic expectations and reduce stress throughout the process.

Below is a general week-by-week breakdown, highlighting the key milestones from the initial research phase to final ownership transfer.

Typical purchase timeline: 6-12 weeks total

Week 1-2: Research phase

Property search and shortlisting

Initial agent contact

Document preparation begins

Week 3-4: Viewing phase

Property visits or virtual tours

Professional inspections

Neighborhood research

Week 5-6: Application phase

Purchase application submission

Price negotiation

Contract preparation

Week 7-8: Contract phase

Contract review and signing

Earnest money payment

Loan application (if applicable)

Week 9-12: Completion phase

Final inspections

Property registration

Ownership transfer

Post-purchase setup

Due diligence checklist

Before committing to a property purchase, it’s essential to conduct thorough due diligence to uncover any legal, structural, financial, or neighborhood-related issues that could affect your investment.

Legal verification

Property title search (登記簿謄本) - confirm clean ownership

Building confirmation certificate (建築確認通知書) - legal construction

Land survey (測量図) - verify boundaries

City planning designation - zoning and building restrictions

Outstanding debts or liens - mortgage or tax obligations

Earthquake hazard map - seismic risk assessment

Physical inspection

Structural integrity - foundation, walls, roof

Plumbing and electrical - age and condition of systems

Insulation and energy efficiency - heating/cooling costs

Pest inspection - termites, mold, rodents

Accessibility - stairs, doorways, bathroom access

Natural disaster risk - flood zones, landslide areas

Financial analysis

Comparable sales - recent transactions in area

Rental market analysis - if investment property

Property tax assessment - annual obligations

Utility connection costs - gas, water, electricity setup

Insurance requirements - earthquake, fire, liability

Renovation needs - budget for immediate repairs

Neighborhood research

Transportation access - train, bus, highways

Shopping and services - convenience stores, medical facilities

School districts - if relevant for families

Noise levels - traffic, construction, neighbors

Future development - planned construction projects

Community associations - chonaikai fees and rules

Professional inspections to order

Structural engineer (¥50,000-¥80,000)

Pest control specialist (¥20,000-¥30,000)

Property appraiser (¥30,000-¥50,000)

Legal title search (¥15,000-¥25,000)

Frequently asked questions

What types of properties can foreigners not buy?

The Foreign Exchange and Foreign Trade Act (FEFTA) placed restrictions on buying land that is designated as “forest” or “agricultural” without permission from the Japanese government. Additionally, some buildings will have rules restricting units to non-Japanese residents. While these are less common, that will depend on the property owner.

Can Americans buy property in Japan?

Americans can buy property in Japan, as there are no citizenship or residency requirements for property ownership. If you are an American abroad, you can contact akiya banks or real estate agents to help you purchase your Japanese property.

Can I get residency if I buy a house in Japan?

Purchasing or owning property in Japan does not create a pathway to visa status. To get a visa, you must apply for one of Japan's visa types (e.g., employee, student, spouse, business manager, highly skilled person, etc.).

How much does it cost to buy a house in Japan?

Housing costs will vary depending on the location of the house you are interested in, the property value, whether the construction is new or not, etc. For example, the purchase price for houses in the Tokyo area can range between 40 million to 80 million yen. Whereas the property price for akiya houses can range from as low as 1 million yen to being entirely free.

How much deposit do I need to buy a house in Japan?

If you are a foreigner with a Japanese visa looking to purchase property in Japan, the deposit may be 20 to 35 percent of the purchase price, depending on the bank you use.

For non-resident foreigners, many Japanese banks may refuse to provide you with a house loan. For those that do, expect the deposit to be between 30 to 40 percent of the purchase price.

In closing

This was a very simple recap of how to buy a house in Japan as a foreigner, whether abroad or in the country.

Understanding the steps and knowing what to prepare will help make the property-buying process easier.

If you're interested in making the process even smoother, consider using MailMate and its property management services.

MailMate can help you pay property taxes, serve as your domestic point of contact and energy liaison, and connect your property to water, gas, electricity, and more.

MailMate's fluently bilingual tax representative service helps property owners stay up to date on their real estate tax bills by liaising between clients and the local government.

The service includes the following features:

Tax representative for annual real estate tax payments

Domestic point of contact for authorities (required by law)

Bill pay support for property tax payments

Tax notifications with English summaries

A virtual mailbox to receive the mail that arrives at your Japanese property

Manage important property documents and notifications in one place

Other services MailMate offers include utility and Internet setup of your Japanese property!

Founded in 2019, MailMate has simplified property ownership for foreigners living abroad and is an increasingly popular option recommended by users and well-known industry figures.

Additionally, if you use MailMate's tax representative service for property owners, MailMate will file the tax representative form with the relevant tax office on your behalf.

Navigate Japan's tax system with an experienced tax representative service tailored for foreign property owners!

Spending too long figuring out your Japanese mail?

Virtual mail + translation services start at 3800 per month. 30-day money-back guarantee.